Governance

Guided with foresight

and experience

Corporate governance is the cornerstone of our operations. To achieve the organisation’s mission and growth goals, we abide by international governance standards and the Tata Code of Conduct.

The Board Philosophy

Corporate governance is a way of life that is ingrained in the organisation’s behaviour and culture. The Company’s philosophy on corporate governance ensures transparency in operations, accountability to stakeholders, and the effective functioning of both management and the Board.

This encompasses financial accountability, ethical corporate behaviour, and keeping in mind the interest of all stakeholders including employees, consumers, vendors, investors, regulators, and society at large. Additionally, it involves monitoring the Company’s overall strategy.

Business Ethics and Compliance

We are committed to operating with the utmost integrity and in accordance with all applicable legal requirements. To ensure that, we have instituted rigorous policies:

Whistle blower policy

Corporate social responsibility policy

Document retention policy

Policy on nomination, appointment and removal of directors

Dividend distribution policy

Anti-bribery and anti-corruption policy

Policy for determining material subsidiaries

Archival

policy

Anti-Money Laundering (AML) Policy

Policy on related party transaction

Group health safety and well‑being policy

Policy on Prevention of Sexual Harassment

Tata affirmative action policy

Remuneration policy

Gifts and Hospitality Policy

Business and human rights policy

Policy on determination of materiality for disclosure

Tata Code

of Conduct

Code of corporate disclosure practices

Board activities and key discussions during the year

- Appointment of Mr. David Crean as Additional (Independent) Director

- Amendment of following policies:

- Dividend Distribution Policy

- Related Party Transactions Policy

- Induction of Mr. David Crean as a Member of Risk Management Committee

- Amendment in Remuneration Policy

- Adoption of Anti-Money Laundering (AML) Policy

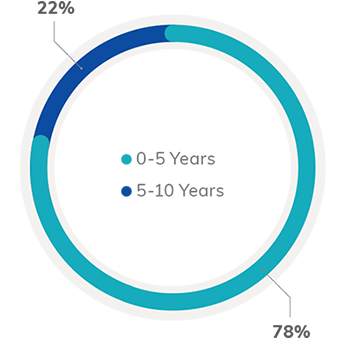

COMPOSITION OF THE BOARD

TENURE OF DIRECTORS