Key performance review

Measuring our progress

Financial

REVENUE FROM OPERATIONS

(INR Crores)

- FY 22-23 13,783

- FY 21-22 12,425

- FY 20-21 11,602

11% (10%*)

11% (10%*)

EBITDA

(INR Crores)

- FY 22-23 1,874

- FY 21-22 1,749

- FY 20-21 1,569

7%

7%

PROFIT BEFORE TAX AND EXCEPTIONAL ITEMS

(INR Crores)

- FY 22-23 1,634

- FY 21-22 1,508

- FY 20-21 1,342

8%

8%

GROUP NET PROFIT

(INR Crores)

- FY 22-23 1,320

- FY 21-22 1,015

- FY 20-21 930

30%

30%

RETURN ON CAPITAL EMPLOYED (ROCE)#

(%)

- FY 22-23 34.3

- FY 21-22 32.8

- FY 20-21 34.7

DIVIDEND

(%)

- FY 22-23 845

- FY 21-22 605

- FY 20-21 405

40%

40%

Segmental

INDIA BUSINESS

(INR Crores)

- FY 22-23 8,717

- FY 21-22 7,914

- FY 20-21 7,003

10%

10%

INTERNATIONAL BUSINESS

(INR Crores)

- FY 22-23 3,589

- FY 21-22 3,336

- FY 20-21 3,508

8% (6%*)

8% (6%*)

NON-BRANDED BUSINESS

(INR Crores)

- FY 22-23 1,500

- FY 21-22 1,214

- FY 20-21 1,122

24% (21%*)

24% (21%*)

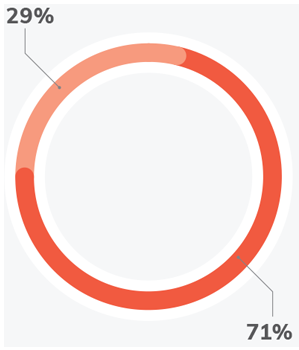

REVENUE – BRANDED BUSINESS IN

FY 22-23

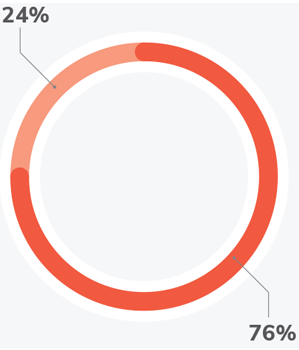

PROFIT BEFORE TAX – BRANDED BUSINESS IN FY 22-23

Environmental

GHG EMISSIONS SCOPE 1

(MT CO2e)

- FY 22-23 6,834

- FY 21-22 11,145

- FY 20-21 13,328

GHG EMISSIONS SCOPE 2

(MT CO2e)

- FY 22-23 19,847

- FY 21-22 20,309

- FY 20-21 19,169

100%

EPR compliance in India. All our Beverages production facilities globally are zero waste to landfill since 2019

314 Million litres

Of water recharged through Project Jalodari. It will contribute to same amount of recharge annually going forward

Founding member

Of the India Plastics Pact

Governance

0%

Independent Directors on Board

0%

Non-Executive Directors on Board

0%

Average Board meeting attendance

0%

Average Audit Committee attendance

0%

Members of the Audit, Risk Management and CSR and Sustainability Committees are Independent Directors

0%

Non-promoter holding

0

Directors in the age group of 40-60 years

0

Directors in the age group of 60-65 years

Proxy Advisory Firms recommended Vote in favour for all shareholder’s resolutions proposed in FY 22-23

0%

Average voting in favour on all shareholder’s resolution passed in

FY 22-23

Social

INVESTMENTS IN CSR PROGRAMMES

(INR Crores)

- FY 22-23 16.6

- FY 21-22 13.5

- FY 20-21 12.0

23%

23%

increase % vs PY

increase % vs PY

*Constant currency growth | # Capital employed= Tangible Net Worth (includes non current investments) + Total Debt + Deferred Tax Liabilities