Our presence

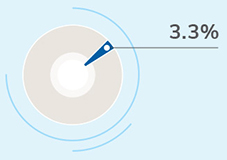

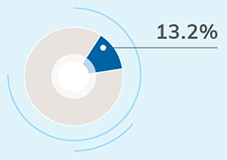

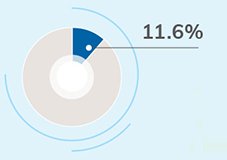

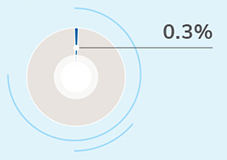

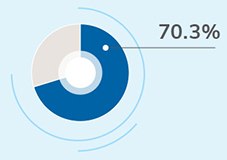

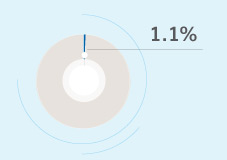

Workforce by region

India

USA

UK

Other regions

Tea

Coffee

Foods

Liquid Beverages

Out-of-Home

N. Chandrasekaran Chairman

N. Chandrasekaran Chairman

Chairman’s letter

"As I had shared with you in last year’s Annual Report, we had identified six strategic priorities for the business. These priorities are key building blocks that power the Company’s growth agenda, and I am pleased to report that we have made substantial progress against each of these during the course of this year."

Know More Meet the board Sunil D’Souza MD & CEO

Sunil D’Souza MD & CEO

Message from the MD and CEO's desk

"We will continue to leverage the trust that the brand inspires, expand our portfolio and increase our footprint to reach more consumers in India. Currently, we reach over 201 million+ households in India and distribute to over 2.6 million outlets."

Know More Meet the Leadership teamKey performance review

REVENUE FROM OPERATIONS

(INR CRORES)

7% (9%*)

increase

EBITDA

(INR CRORES)

11%

increase

PROFIT BEFORE TAX AND EXCEPTIONAL ITEMS

(INR CRORES)

12%

increase

GROUP NET PROFIT

(INR CRORES)

9%

increase

RETURN ON CAPITAL EMPLOYED

(ROCE) (%)

INDIA BUSINESS

(INR CRORES)

13%

increase

INTERNATIONAL BEVERAGES

(INR CRORES)

-5% (1%*)

increase

NON-BRANDED BUSINESS

(INR CRORES)

8%

increase

GHG EMISSIONS

(MTCO2e)

The increase in GHG emissions between FY 19-20 to FY 21-22 is because of the integration of the Foods business and addition of a new location to the operational

*Assurance underway

RENEWABLE ENERGY

(%)

EPR compliance in India. All our Beverages production facilities globally are zero waste to landfill since 2019

Of water recharged through Project Jalodari. It will contribute to same amount of recharge annually going forward

Of the India Plastics Pact

TOTAL LEARNING HOURS

(HOURS)

INVESTMENTS IN CSR PROGRAMMES

(INR CRORES)

Value creation model

Financial Capital

Sources of funds debt: INR 1,468 Crore; equity INR 1,6294 Crore

Intellectual Capital

R&D expenditure: INR 23.87 crores in 2021-22

Human Capital

Global employee strength: 3,700+

Social & Relationship Capital

Community: Spent INR 13+ crore; 5 thematic areas; 8+ partnerships for CSR implementation

Natural Capital

Water used for operations: 1.7 lakh KL

Manufactured Capital

119 locations worldwide (including manufacturing units, corporate offices and dedicated third party units)

Financial Capital

Revenue from operations: INR 12,425 crore; Market Capitalisation: INR 71,645 crore

Intellectual Capital

25 new products launched in India and other geographies

Human Capital

Employee advocacy: Internal transfers and referrals filling 50% of the open positions

Social & Relationship Capital

Community: 8 CSR programmes positively impacting 8 lakh beneficiaries

Natural Capital

Responsible manufacturing operations: Zero waste to landfills across beverage units, 7,000+ tonnes of recycled material in packaging

Manufactured Capital

1.44 million tonnes of production globally

Financial Capital

Growth in consolidated revenue: 7% and net profits: 9%

Intellectual Capital

Innovation to sales: 2x of previous year

Human Capital

Future-ready workforce

Social & Relationship Capital

Driving premiumisation – scaling up our premium portfolio across core categories

Natural Capital

Strong advocacy of environmental stewardship extending beyond our boundaries

Manufactured Capital

Agile and future-ready manufacturing facilities

Safety enhancement by automation