Key performance review

Measuring our progress

REVENUE FROM OPERATIONS

(INR Crores)

- FY 22-23 13,783

- FY 21-22 12,425

- FY 20-21 11,602

11% (10%*)

11% (10%*)

EBITDA

(INR Crores)

- FY 22-23 1,874

- FY 21-22 1,749

- FY 20-21 1,569

7%

7%

PROFIT BEFORE TAX AND EXCEPTIONAL ITEMS

(INR Crores)

- FY 22-23 1,634

- FY 21-22 1,508

- FY 20-21 1,342

8%

8%

GROUP NET PROFIT

(INR Crores)

- FY 22-23 1,320

- FY 21-22 1,015

- FY 20-21 930

30%

30%

RETURN ON CAPITAL EMPLOYED (ROCE)#

(%)

- FY 22-23 34.3

- FY 21-22 32.8

- FY 20-21 34.7

DIVIDEND

(%)

- FY 22-23 845

- FY 21-22 605

- FY 20-21 405

40%

40%

* Constant currency growth | # Capital employed= Tangible Net Worth (includes non current investments) + Total Debt + Deferred Tax Liabilities

INDIA BUSINESS

(INR Crores)

- FY 22-23 8,717

- FY 21-22 7,914

- FY 20-21 7,003

10%

10%

INTERNATIONAL BUSINESS

(INR Crores)

- FY 22-23 3,589

- FY 21-22 3,336

- FY 20-21 3,508

8% (6%*)

8% (6%*)

NON-BRANDED BUSINESS

(INR Crores)

- FY 22-23 1,500

- FY 21-22 1,214

- FY 20-21 1,122

24% (21%*)

24% (21%*)

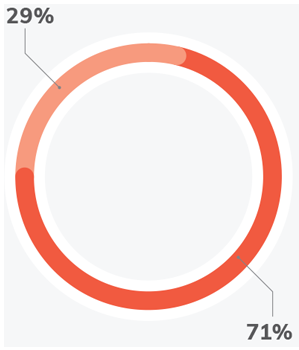

REVENUE – BRANDED BUSINESS IN

FY 22-23

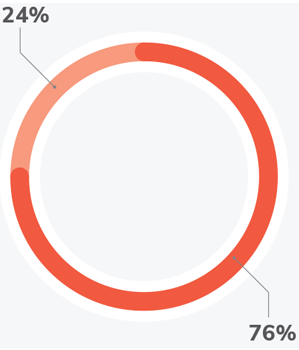

PROFIT BEFORE TAX – BRANDED BUSINESS IN FY 22-23

GHG EMISSIONS SCOPE 1

(MT CO2e)

- FY 22-23 6,834

- FY 21-22 11,145

- FY 20-21 13,328

GHG EMISSIONS SCOPE 2

(MT CO2e)

- FY 22-23 19,847

- FY 21-22 20,309

- FY 20-21 19,169

100%

EPR compliance in India. All our Beverages production facilities globally are zero waste to landfill since 2019

314 Million litres

Of water recharged through Project Jalodari. It will contribute to same amount of recharge annually going forward

Founding member

Of the India Plastics Pact

56%

Independent Directors on Board

78%

Non-Executive Directors on Board

96%

Average Board meeting attendance

96%

Average Audit Committee attendance

100%

Members of the Audit, Risk Management and CSR and Sustainability Committees are Independent Directors

65.59%

non-promoter holding

4

Directors in the age group of 40-60 years

5

Directors in the age group of 60-65 years

Proxy Advisory Firms recommended Vote in favour for all shareholder’s resolutions proposed in FY 22-23.

99.80%

Average voting in favour on all shareholder’s resolution passed in FY 22-23

INVESTMENTS IN CSR PROGRAMMES

(INR Crores)

- FY 22-23 16.6

- FY 21-22 13.5

- FY 20-21 12.0

23%

23%

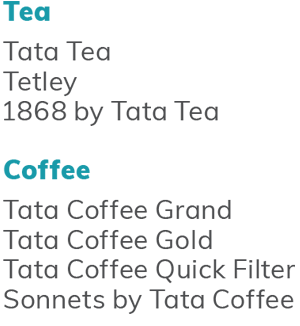

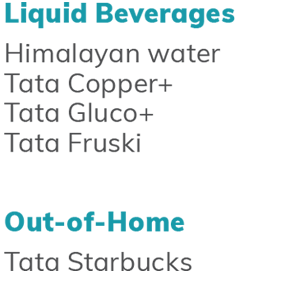

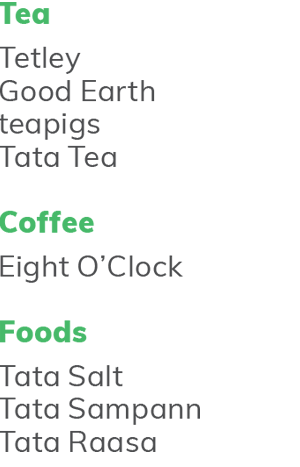

Tata Consumer’s

F&B platforms

Three years of

Tata Consumer

BRANDED BUSINESS(%)

India vs International

- FY 22-23 29 71

- FY 21-22 30 70

- FY 20-21 33 67

INDIA BUSINESS(%)

Beverages vs Food

- FY 22-23 42 58

- FY 21-22 37 63

- FY 20-21 35 65

INDIA GROWTH BUSINESSES*(%)

Revenue growth rate

- FY 22-23 53

- FY 21-22 52

- FY 20-21 69

INDIA GROWTH BUSINESSES*(%)

Contribution to India business

- FY 22-23 15

- FY 21-22 10

- FY 20-21 8

*India Growth businesses include Tata Sampann, NourishCo, Tata Soulfull, and Tata Smartfoodz (RTE/RTC Business).

EXPANDING DIRECT AND TOTAL REACH(Mn outlets)

- FY 22-23 1.5 3.8

- FY 21-22 1.3

- FY 20-21 0.7

CHANNELS OF THE FUTURE(%)

Contribution to India business

- FY 22-23 27 73

- FY 21-22 24 76

- FY 20-21 19 81

INDIA INNOVATION TO REVENUE(%)

- FY 22-23 3.4

- FY 21-22 2.7

- FY 20-21 1.4

NUMBER OF NEW LAUNCHES PER YEAR

- FY 22-23 34

- FY 21-22 19

- FY 20-21 14

EMPLOYEE EXPENSE TO REVENUE(%)

- FY 22-23 4.6 8.1

- FY 21-22 4.4 8.4

- FY 20-21 4.5 8.4

- FY 19-20 5.0 9.2

EBITDA MARGIN(%)

- FY 22-23 15.5 13.6

- FY 21-22 14.0 14.1

- FY 20-21 12.8 13.5

- FY 19-20 14.2 13.6

OTHER EXPENSES TO REVENUE# (%)

- FY 22-23 12.4 14.0

- FY 21-22 12.8 14.0

- FY 20-21 11 12.6

- FY 19-20 13.1 14.2

DAYS OF OPERATING WORKING CAPITAL

- FY 22-23 35

- FY 21-22 38

- FY 20-21 42

- FY 19-20 59

Value Creation Model

Creating value for all

WE ARE GUIDED BY OUR VALUES TO FULFILL OUR MISSION

Our sights are set on playing an increasingly more significant role in the consumer products market. We are committed to building better lives and thriving communities and helping create a better world for everyone.

Know MoreTO ACHIEVE OUR BUSINESS GOALS, WE HAVE SIX STRATEGIC PRIORITIES

Strengthen and accelerate core business

Drive digital and innovation

Unlock synergies

Explore new opportunities

Create a future-ready organisation

Embed sustainability

CREATING A LASTING POSITIVE IMPACT ON OUR STAKEHOLDERS

Consumers

People

Communities

Government and regulatory authorities

Investors

Value chain partners

Environment and ecosystem

PURPOSE-DRIVEN ORGANISATION

We are a future-ready, purpose-led organisation, with people as our strength. Hence, we focus on their progress, creating a safe and equitable workspace in our journey ‘For Better’.

3,900+

Global Branded Workforce strength

15,703 hours

Invested in Trainings

1,200+

Women in workforce

OPERATIONAL EXCELLENCE

Our strategically located manufacturing and packaging facilities and a centralised product supply organisation help deliver high-quality products to our consumers.

119

Locations worldwide (including manufacturing units, corporate offices and dedicated third party units)

3

World-class R&D facilities to drive product innovation

CONSUMER CENTRICITY

High quality products that cater to consumer needs are our value proposition to our consumers. Higher levels of consumer awareness and demand have led to newer ways of staying connected.

- Market leadership in salt and tea in most markets where we operate.

- Inputs from consumer surveys on preferred product attributes (e.g. flavour)

STRATEGIC PARTNERSHIPS

We are transforming our supply chain to better serve our customers efficiently in a competitive market. Having pioneered sustainable tea and coffee sourcing via partnerships, we are committed to replicating it for the other parts of our product portfolio.

~1.5 million

Directly serviced outlets

11,000+

Distribution partners (including retailers and D2C)

INNOVATION AND DIGITALISATION

Leveraging our digital and R&D capabilities, our portfolio of great-tasting products is designed to cater to evolving consumer needs. This year, we focused on integrating digital capabilities across business units and partner ecosystems.

- Dedicated R&D team of 35 Professionals

- R&D expenditure of INR 36.35 crores in FY 22-23

- Digital tools across the value chain

SUSTAINABILITY FOCUS

We rely on nature for material (agricultural products) and process (water, energy etc.) inputs for our business process viz., sourcing, processing, packaging, and distribution. We try to ensure that our environmental footprint is minimal and reversible.

- 1,08,000+ TJ Energy

- 3,03,272 KL Water

- 7,000+ tonnes of recycled material in packaging

FINANCIAL PRUDENCE

Optimal capital allocation to drive organic and inorganic growth.

- Revenue from operations: INR 13,783 crores

- Source of funds

- − Debt: INR 1,183 crores

- − Equity: INR 17,127 crores

- Capex: INR 312 crores

- Operating Working Capital: INR 1,450 crores

GOVERNANCE AND RISK MANAGEMENT

Uphold the highest levels of corporate governance ensuring streamlined business operations. Our robust risk management framework enables us to identify, address and mitigate the existing and emerging risks that are posed to our business.

CONSUMER BEHAVIOUR AND TRENDS

Consumer connects, social listening, and understanding behavioural changes facilitates building purposeful brands

INNOVATION

By leveraging consumer insights, we continue to address untapped and emerging consumer needs through our product and category innovations

SOURCING

Sustainable sourcing is an integral part of our strategy; Transformation of our supply chain is helping us create a more efficient, cost-effective and sustainable footprint

MANUFACTURING AND PACKAGING

We are integrating operations and leveraging technology in our manufacturing processes and on packaging circularity

DISTRIBUTION

Our distribution networks work efficiently to take our products to millions of households

MARKETING AND SELLING

Transparency and responsible marketing have helped us enjoy high levels of consumer trust

FOR BETTER SOURCING

Dedicated to ensuring that our products are produced in an economically, environmentally, and socially just manner.

Vision

Sustainable value chains from farm to shelf.

Targets

100%

Critical supplier assessments across all geographies by 2030

100%

Sustainably sourced critical raw materials by 2040

FOR A BETTER PLANET

Committed to sustainable utilisation of major natural resources, such as land, water, air, and wild flora and fauna.

Vision

Clean energy, water replenishment, preservation of biodiversity, and circular economy.

Targets

Net Zero

By 2040 across all geographies

Zero waste

To landfill by 2030 across all geographies

Water neutral

Across all operations by 2030

100%

Of packaging material to be recyclable, compostable, or reusable across all geographies by 2030

FOR BETTER COMMUNITIES

Belief in the Tata Group philosophy of giving back to the community and acknowledging the role played by communities in business growth.

Vision

Enhance the quality of life, creating shared value for our communities. Foster an equitable, inclusive, and safe culture.

Targets

2 Mn

Beneficiaries by 2030

50%

Diverse workforce across all geographies by 2030

FOR BETTER NUTRITION

Portfolio of great-tasting products that are designed to enhance health and well-being.

Vision

Improved access to healthy, natural, and safe food for our consumers.

Targets

250 Mn

Households in India to be reached through our product portfolio by 2030

100%

Sustainable products* by volume by 2040

Capitals

Financial

Intellectual

Human

Social and Relationship

Natural

Manufactured

Material Issues

Access to nutrition

Consumer Connect

Human Rights

Responsible Marketing

Value Chain Management

Community Engagement

Product Stewardship

Innovation & Technology

Circular Economy

Responsible Sourcing

Driving Net Zero

Preserving Nature & Biodiversity

Corporate Governance

Equitability

Employee wellness, Engagement and Health & Safety

Training and Education

CONSUMER

200+ Mn households reach in India

24% of new innovations focused on Health and Wellness

34 new products launched in India and other geographies

8 new products with additional nutritional attributes

Direct outlet reach of 1.5 million retail outlets and total reach of 3.8 million outlets

PEOPLE

1,200+ women in workforce

31% of the open positions filled by Internal transfers

95% talent retention (global graded population)

Diversity, Inclusion, Equity, Belonging DIEB - 77, Engagement Score - 73

Zero fatalities across manufacturing facilities

COMMUNITIES

12.5 lakhs beneficiaries positively impacted through our 10 CSR programmes

Collaborations and partnerships with Ethical Tea Partnership (ETP), trustea, India Plastics Pact, UK and EU Plastic Pacts

GOVERNMENT AND REGULATORY AUTHORITIES

Setting industry benchmarks and promoting the sustainability agenda

Transparency in financial reporting and tax matters; FY 22-23 INR 389 crores in direct taxes

INVESTORS

Making progress on ESG via our ESG strategy and through specific commitments on all parameters

Robust financial returns; FY 22-23 INR 558 crores distributed as dividends, up 40%. EPS up 28%

VALUE CHAIN PARTNERS

25% Growth in alternate channels

Mutually beneficial partnerships that help realise efficiencies

>2X the number of channel partners (distributors) from FY 20-21 to FY 22-23

55% of Tata Tea sustainably sourced

ENVIRONMENT AND ECOSYSTEM

100% compliance with EPR

Support RE installations in supply chain - 19% renewable energy share.

Steady progress towards water neutrality

Presence

Our global footprint

Workforce by region*

AUSTRALIA

INDIA

MIDDLE EAST

UK AND EUROPE

UK AND EUROPE

SOUTH AFRICA

CANADA

USA

Map not to scale

Geography / Contribution**This doesn’t include non-branded business

STRATEGY

Stakeholder engagement and materiality

Stakeholders in focus and topics of priority

CONSUMERS

CONSUMERS

PEOPLE

PEOPLE

COMMUNITIES

COMMUNITIES

GOVERNMENT AND REGULATORY AUTHORITIES

GOVERNMENT AND REGULATORY AUTHORITIES

INVESTORS

INVESTORS

VALUE CHAIN PARTNERS

VALUE CHAIN PARTNERS

ENVIRONMENT AND ECOSYSTEM

ENVIRONMENT AND ECOSYSTEM

Risk management

Mitigating risks robustly

- COMMODITY SOURCING

- CYBERSECURITY

- BRAND EQUITY

- BUSINESS ACQUISITION AND INTEGRATION

- COMPLIANCE AND REPUTATION

- SUSTAINABILITY

- CHANGING CONSUMER PREFERENCES

- PEOPLE

- SALES AND DISTRIBUTION