CONSUMERS INCREASINGLY WANT PRODUCTS AND SERVICES THAT ARE...

Healthy, seasonal and nutritional

Consumers are becoming more health-conscious, proactively focusing on a balanced nutrition and an active lifestyle.

Fresh, seasonal ingredients; unprocessed, natural and organic foods; foods with favourable nutritional profiles; and plant-based alternatives dominate preferences today.

Households are rediscovering the hidden powers in their kitchen, namely spice mixes that can bring excitement to any dish and provide a boost to health.

Customised, unique and local yet global

Today’s palettes are far more flexible and adventurous.

Consumers are keen on experimenting with drinking and snacking options that feature a variety of flavours. There is a growing interest in ethnic mashups, where flavours and techniques are fused to create signature options.

Convenience led, experience driven and personal

Households are gradually becoming smaller and everyday lives are busier than before. As a result, convenience continues to be a key motivator in choosing away-from-home socialising occasions.

Cold refreshments that are consumed away from home are steadily gaining popularity, and not just in the summer months. Herbal flavours and tea based ready-to-drink non-carbonated options that cannot be replicated at home, rank high on satisfying beverage cravings.

At the same time, quality at-home food and drink options are likely to witness greater traction in the near term.

Good for the planet and ethically sourced

As social consciousness grows, today’s customers want to know the stories behind where their food and drink come from.

Qualities like local, organic, sustainable sourcing, corporate performance, diversity and environmental impact, among others, are all important to consumer choices in varying degrees.

Social media friendly and sensory thrillers

Technology and smartphones are changing the way consumers interact with brands and the way companies are looking at supply chains.

Over the years, Instagram and other photo-sharing apps have revolutionised the consumer-facing industry. Social media is shaping category and brand perceptions, and micro-influencers are gaining credibility in promoting products and services.

| OUR RESPONSE | WE ARE DELIVERING THROUGH... | |

|---|---|---|

Portfolio focus Portfolio focus |

|

|

Product

innovation Product

innovation |

|

|

Social hubs

for food and

beverage Social hubs

for food and

beverage |

|

|

Sustainability

considerations Sustainability

considerations |

|

|

Accelerating

digital Accelerating

digital |

|

|

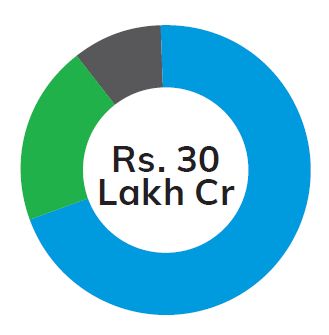

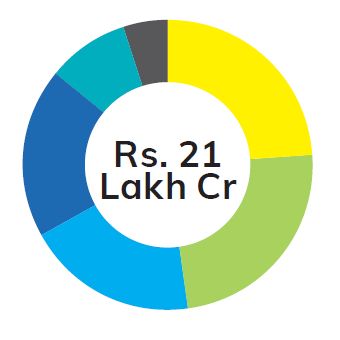

FOOD AND BEVERAGE – A RS. 30 LAKH CRORE OPPORTUNITY

India's food and beverage consumption in 2019 is estimated at ~Rs. 30 Lakh Crores. The 'in-the-kitchen' segment, comprising staples, spices and condiments, dairy and others, accounts for ~70% of the food and beverage basket, or ~Rs. 21 Lakh Crores. However, the share of organised players in this segment is less than 10% and remains largely untapped. The other segments, 'on-the-table' (comprising spreads, sauces and others) and 'on-the-go' (comprising snacks, ready-to-eat options and others) have traditionally seen larger play by organised players, but their offerings are skewed towards indulgent snacking products. The industry is also witnessing a shift in consumer preferences, with demand for healthier, better quality and more affordable food and drink options growing across all the three segments.

Market size 2019

70%: In-the-kitchen

20%: On-the-table

70%: On-the-go

In-the-kitchen

24%: Dairy

24%: Fresh Produce

19%: Staples

19%: Edible Oils

9%: Spices

5%: Others

Source: PwC; Edelweiss Report; and Company analysis

EVOLVING CONSUMER BEHAVIOUR

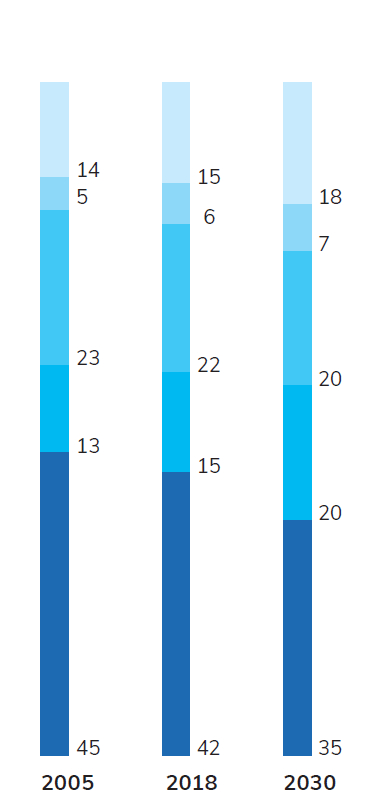

Rising affluence

Rising affluence of Indian households will lead to premiumisation and higher demand for products that are healthy, provide well-being and are convenient to use.

1 in 2 households in 2030 will belong to the high and upper-middle income segments (compared with 1 in 4 households today).

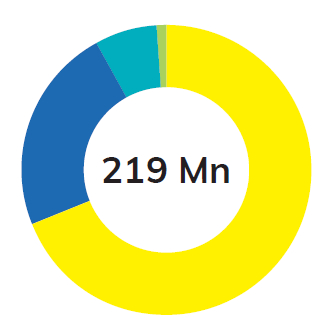

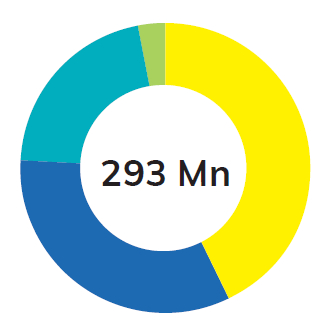

Household mix#

2005

69% (151 Mn)

23% (51 Mn)

7% (16 Mn)

1% (1 Mn)

2018

43% (127 Mn)

33% (97 Mn)

21% (61 Mn)

3% (8 Mn)

2030

15% (57 Mn)

34% (132 Mn)

44% (168 Mn)

7% (29 Mn)

Lower income: <USD 4,000

Lower-mid: USD 4,000-8,500

Upper-mid: USD 8,500-40,000

High income: >USD 40,000

basis income per household in real terms

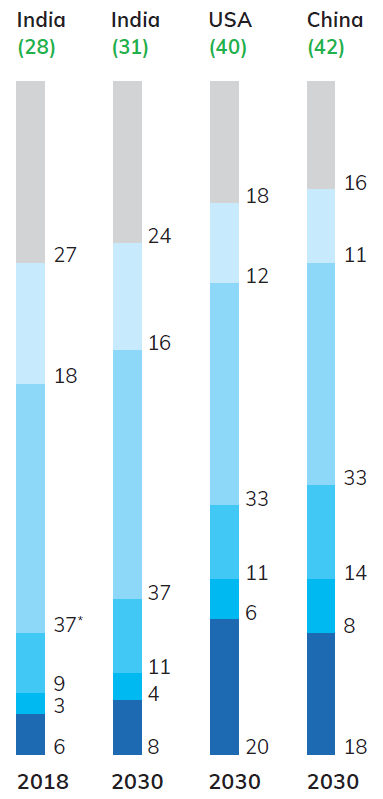

India's young consumer

India will witness the rise of the Gen-Z consumer – tech savvy, aspirational and desirous of engaging with brands across multiple channels.

Demographic mix (%)#

Median age

>=65

50-59

15-24

60-64

25-29

<=15

*Millennials born during 1981-2005 Gen Z is born post 2005

Consumption gap between

rural and

urban to narrow

Consumption mix (%)#

Rest of rural

Boom town

Developed rural

Metro

Rest of urban

#Source: WEF Report

We perceive a large and transformational market opportunity ahead of us and we aim to leverage our strengths to become a formidable player across the three segments of in-the-kitchen, onthe- table and on-the-go, offering products that are high in quality, innovative, delightful and made with goodness and care.

Key value drivers

Portfolio of market leading brands and high growth potential brands

Presence across 200 million households in urban and rural India

Deep understanding of consumers and an omnichannel presence

Innovation-led culture with focus on health and well-being products

Legacy and the trust embodied by the Tata brand

Wide distribution network of ~2.5 million retail outlets across India

With a proven ability to win, Tata Consumer is well positioned to ride the next consumption wave in India.