Results for the Quarter ended 30th June 2025

Results for the quarter ended 30 th June 2025 Consolidated Results

Tata Consumer Products delivered steady topline growth

Robust growth in India Packaged Beverages; India Foods continued strong trajectory

Financial Highlights

Revenue from Operations for the quarter at Rs 4,779 Crores, up 10%

India business recorded double digit growth; enabled by strong growth in both core categories of tea and salt, supported by underlying volume gains

Tata Sampann continued its strong momentum, but the RTD business volume growth was impacted by unseasonal rains.

The international business continued its momentum with a 5% constantcurrency revenue growth

Consolidated EBITDA for the quarter at Rs 615 Crores, declined 8% due to higher tea costs in India and coffee price corrections in the non branded business

Group Net Profit for the quarter at Rs 332 crores, up 15%

Tata Consumer Products Ltd. today announced its results for the quarter ended 30th June 2025

Some of the key Business updates are:

India

India Beverages Business - Strong growth in tea and coffee

- For the quarter, India packaged beverages business revenue grew 12%. Coffee continued its strong trajectory with a revenue growth of 67% for the quarter.

- In line with our focus on Health & Wellness and Premiumization, Tetley introduced Slim Care and Beauty Care green teas enriched with L- Carnitine and Biotin respectively.

- RTD (Ready to Drink) business was impacted by unseasonal rains and recorded a moderate volume growth of 3%. Strong portfolio expansion continued with the launch of 8 new products across new segments, formats, and occasions.

- Organic India partnered with Sachin Tendulkar, aligning his reputation for integrity with the brand’s emphasis on quality and trust.

Foods Business - Continued momentum in value added salts and Tata Sampann

- For the quarter, India Foods business revenue grew 14%.

- Tata Salt launched “Namak Ho Tata Ka 2.0” to reinforce its brand promise, featuring region-specific musicals and broad activation across major TV, digital, and high-impact platforms.

- Value-added salt portfolio continued its strong growth and grew 31% during the quarter.

- Tata Sampann portfolio continued to perform well and grew 27% for the quarter.

- Dry fruits and Cold pressed oil continued to build on their growth momentum.

- Capital Foods activated media on quick commerce platforms to strengthen brand association with the channel.

Innovation & driving execution excellence- Value added products launched across categories, omni channel capabilities strengthened

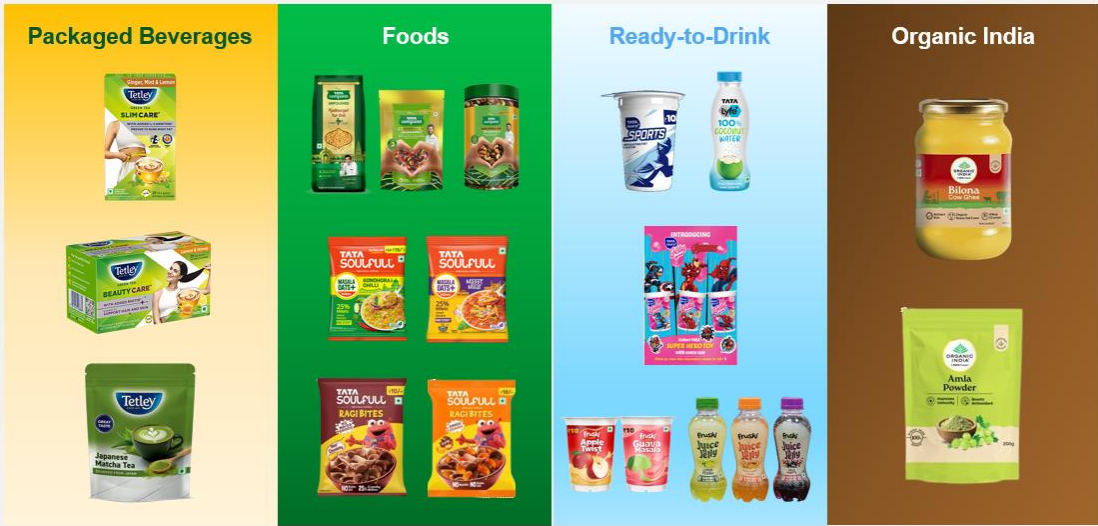

- Momentum on innovation continued with focus on Heath & Wellness, Convenience and Premiumization. Below is a snapshot of some of the launches during the quarter.

- Channels of the future continued to fuel our growth and innovation agenda. Ecommerce channel grew 61% and Modern Trade recorded 21% growth in the quarter.

- New channels - Rollout in Food Services and Pharmacies to fuel growth are progressing as per plan. Food Services saw successful activation across key large accounts and premium hotel chains. Pharmacies distribution has expanded to the top 40 cities.

International Business- Continued steady momentum

- For the quarter, the International business revenue grew 5% in constant currency terms, driven by strong coffee performance in the USA.

- In the UK, Tetley’s new TV ad titled ‘Britain’s tea’ was well received by consumers.

- In the USA, the coffee business registered strong growth. Eight O’ Clock coffee continued to gain market share within bags as well as K-Cups.

Tata Starbucks- Continued footprint growth across metros as well as smaller cities

- In line with its store addition plans, Tata Starbucks added 6 net new stores during the quarter. This brings the total number of stores to 485 across 80 cities.

- The Cold Brew category continued to grow, contributing to a larger share of the beverage menu mix.

- Gen-Z focused ‘Refreshers’ further contributed to growth by driving incremental trials.

Sunil D’Souza, Managing Director & CEO of Tata Consumer Products said

“We delivered a steady topline growth of 10% in Q1 FY26, with double-digit net profit growth.

During the quarter, we recorded double-digit growth in the core India business across both tea and salt backed by volume growth. Tata Sampann continued its strong trajectory, with new launches & innovations performing well. However, unfavourable weather impacted volume growth in the RTD business. While transitory issues impacted growth in Capital Foods and Organic India, our focus now turns to delivering on our aspirations in these businesses through ramping up advertising, innovation and distribution expansion.

We delivered yet another quarter of strong performance in the International Business; with margin being accretive to the India business margins.

In India, we continued to strengthen omni channel capabilities including food services and pharmacy, with channels of the future (e-commerce and modern trade), demonstrating robust growth.

Tata Starbucks continued to expand its store footprint across metros and smaller cities across India with a total store count of 485 stores across 80 cities.”

About Tata Consumer Products Limited

Tata Consumer Products Limited is a focused consumer products company uniting the principal food and beverage interests of the Tata Group under one umbrella. The Company’s portfolio of products includes tea, coffee, water, RTD, salt, pulses, spices, ready-to-cook and ready-to-eat offerings, breakfast cereals, snacks and mini meals. Its key beverage brands include Tata Tea, Tetley, Organic India, Eight O’Clock Coffee, Tata Coffee Grand, Himalayan Natural Mineral Water, Tata Copper+ and Tata Gluco+. Its foods portfolio includes brands such as Tata Salt, Tata Sampann, Tata Soulfull, Ching’s Secret and Smith & Jones. In India, Tata Consumer Products has a reach of over 275 million households, giving it an unparalleled ability to leverage the Tata brand in consumer products. The Company has a consolidated annual turnover of Rs. 17,618 Crs with operations in India and International markets. Last 10-year financials are available on Historical financial data.

For more information on the Company, please visit our website www.tataconsumer.com

Disclaimer:

Some of the statements in this communication may be forward looking statements within the meaning of applicable laws and regulations. Actual results may differ from such expectations, projections etc., whether express or implied. These forward-looking statements are based on various assumptions, expectations and other factors which are not limited to, risk and uncertainties regarding fluctuations in earnings, competitive intensity, pricing environment in the market, economic conditions affecting demand and supply, change in input costs, ability to maintain and manage key customer relationships and supply chain sources, new or changed priorities of trade, significant changes in political stability in India and globally, government regulations and taxation, climatic conditions, natural calamity, commodity price fluctuations, currency rate fluctuations, litigation among others over which the Company does not have any direct control. These factors may affect our ability to successfully implement our business strategy. The Company cannot, therefore, guarantee that the ‘forward-looking’ statements made herein shall be realized. The Company, may alter, amend, modify or make necessary corrective changes in any manner to any such forward looking statement contained herein or make written or oral forward-looking statements as may be required from time to time on the basis of subsequent developments and events.